This article collaboration on business data first appeared on Whispr Group.

Imagine sitting at your desk with a self-evaluation form to fill out. The standardized template in front of you is there to make your answers more comparable and — hopefully! — guide you through the process. Now, according to yourself, how well did your last marketing campaign or communication campaign actually perform? Ultimately the question is, how well are you performing at your job?

Even if you’re being honest, how do you know whether or not you’re unconsciously biased?

All companies are using business data to evaluate themselves. But the worse the performance, the bigger the risk for skewing the analysis. So, how do you validate your business-critical data?

Self-appraisal isn’t the path to unbiased insights

Self-appraisal can be useful, for sure. It allows employees to clarify their view of their work so that it can be compared to that of their managers. Also, the ritual might encourage employees to frame their contributions in a bigger business context. Unfortunately, beyond specific psychological use cases, the concept of self-appraisal is mostly a terrible idea.

The purpose of analyzing business data is all about arriving at actionable insights to inform better decisions. The majority of all companies today are collecting and analyzing their performance data on the brand level using the self-appraisal method. To put it mildly: Self-appraisal isn’t a very scientific way to acquire business-critical insights from data.

The polar opposite of self-appraisal is peer-appraisal. The main advantage is obvious — peer-appraisal is much more efficient in producing accurate knowledge.

The fallacy of overestimating self-performance

In Let’s Abolish Self-Appraisal published by the Harvard Business Review in 2011, the author and management expert Dick Grote writes:

“In researching my book How to Be Good at Performance Appraisals, I found study after study that consistently demonstrated that individuals are notoriously inaccurate in assessing their own performance, and the poorer the performer, the higher (and more inaccurate) the self-appraisal.”

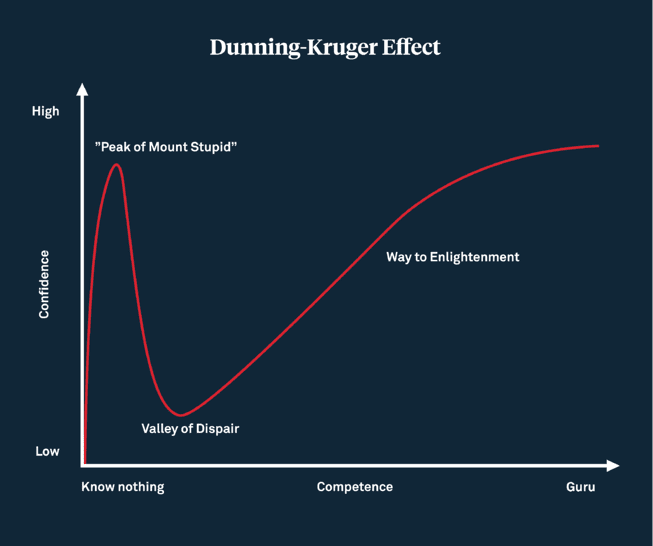

Justin Kruger and David Dunning (as made famous by the discovery of the Dunning-Kruger Effect) published an article in the Journal of personality and Social Psychology in which they conclude that less skilled individuals suffer a dual burden:

“Not only do these people reach erroneous conclusions and make unfortunate choices, but their incompetence robs them of the metacognitive ability to realize it.”

A strategy based on third-party insights

Few brands have a strategy or process in place for validating their data analysis.

Companies often allocate money on product launches and marketing campaigns, yet they often base these decisions on biased business data. According to what the science implies, self-appraisal is likely to be used primarily for individual gains or worse — to reinforce an inflated brand image that only exists internally. A company evaluating its own performance is treading on thin ice.

While it’s true that the digitization of the business world offers unprecedented opportunities for extracting data, data is still just a tool. And as is true for all types of tools: If you use it wrong, you might just end up hurting yourself instead of fixing something.

This is where Whispr Group, as an independent global service provider, tasked with turning data into actionable insights, has taken its stand. Joakim Leijon, Whispr Group’s Founder and CEO, writes:

“Our business model critically depends on our ability to provide our clients with unbiased and scientifically accurate analysis of their data which they can act on. If we fail in this endeavour, our clients fail. In our last two NPS surveys, we’ve averaged an 8,8 out of 10 — which indicates that our clients are finding our analysis highly valuable.”

How to validate your data analysis

Whispr Group suggests the following key takeaways in avoiding the pitfalls of corporate self-assessment of business data:

1. Collect and analyze business data with the intent to gain business-critical knowledge, not to bolster internal careers or support already-made decisions (more info: How the right insights will help you set the right KPIs).

2. Always verify your business data via an independent third-party analyst to avoid the Dunning-Kruger Effect (more info: Get started with insights from Whispr Group).

3. Nurture a corporate culture that acknowledges that the truth can be painful at times, but that, by any measure, ignorance is far worse for business. (more info: Stop just collecting insights and start using the insights from it).

Does your business need a second opinion on a specific data set? Get in touch with one of Whispr Group’s data analysts for a free consultation.

Photo by JC Gellidon on Unsplash.